Pennsylvania’s Public Utility Commission (PUC) is distributing nearly $210 million in natural gas drilling tax revenue to municipalities across the state based on 2017 production, as we begin the new fiscal year without the economic burden of a natural gas severance tax.

The $210 million in funding is the result of Pennsylvania’s Act 13, commonly referred to as the Impact Fee, which allows authorized county governments to impose an impact tax on each unconventional natural gas well. It is assessed annually and calculated based on the price of natural gas and the age of the well. The PUC is tasked with collecting the tax from producers and allocating the funds to the following four categories:

- County and municipal governments where shale gas development occurs

- Statewide environmental grant programs, such as Growing Greener, the Marcellus Legacy Fund, and water and sewer infrastructure

- All 67 counties for conservation, recreation, and bridge repairs

- State governmental agencies, including the Department of Environmental Protection, PUC, Fish and Boat Commission, Emergency Management Agency, and the Office of the State Fire Commission, which oversees shale gas development

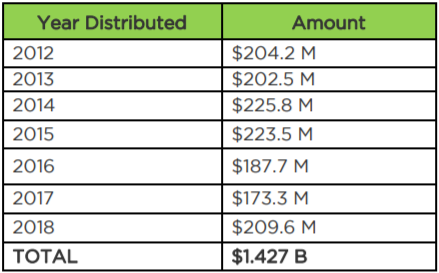

Pennsylvania’s Impact Fee—the only tax of its kind nationwide—was designed to boost local funding and enhance environmental programs, according to the Marcellus Shale Coalition. Local governments have the authority to decide how to spend the funds they receive based on 13 approved uses contained in Act 13, such as public infrastructure improvements, emergency preparedness and response, environmental protection, and tax reduction. Since Act 13 was signed into law in 2012, it has generated nearly $1.5 billion dollars in new revenue for communities across Pennsylvania.

Pennsylvania passed its $32.7 billion budget on June 22, which failed to include Governor Tom Wolf’s request for a severance tax, which would tax based on the volume of natural gas extracted. Wolf has been pushing for the tax, which would likely cost producers between four and seven cents per thousand cubic feet of natural gas depending on its price, for the past four years. Its intended purpose: to generate money to help the state’s distressed finances. But opponents argue higher taxes on Pennsylvania’s natural gas industry could prove counterproductive by steering away development to other gas-producing states with lower total costs, stunting investment and job growth in the Commonwealth, and redirecting tax revenue to Pennsylvania’s general fund and away from local governments that need it more.

Pennsylvania is the only major gas-producing state without a severance tax, but it is also the only state with an impact fee—which is working exactly as designed by fixing local roads and funding local infrastructure. For now, it seems Governor Wolf’s resounding call for his natural gas severance tax has fizzled while he focuses on re-election in November. Yet, if he retains his seat, it likely will not be long before the issue resurfaces.

Penn E&R stands with its clients in the oil and gas industry assisting in the safe, environmentally friendly exploration of natural gas to supply homes and businesses for years to come. If you have questions or comments, contact a Penn E&R professional at 215-997-9000.